2

Agenda

Supply Chain Finance Solution

We provide short term liquidity to small business in small towns with an omni channel

approach – fin-tech platform support by distribution network

3

• To Emerge as a Strong Fintech Platform in sync with Government of India digital Initiatives and

Regulators Financial Incubator objectives.

• Seamless Integration across platform for Matured Credit Scoring and Social Verification based on

non-traditional data

• Habit forming Intuitive UI, UX and Workflow to make the borrower ‘GO DIGITAL ’ and

encourage the Borrower to take digital payments from his customers

• Real Time approvals and payment transfers by Technology Driven Automated Processes

• Connecting Borrowers and 3

rd

party lenders with Cutting Edge Technology as a core on a Trusted

and Secured Platform

• Reduce Operational Cost by enabling Technology driven processed for Customer Acquisition

Underwriting , Origination and Servicing.

Take first mover advantage in small towns by encouraging small business to adopt technology

with habit forming UX

Technology Objective

4

Agenda

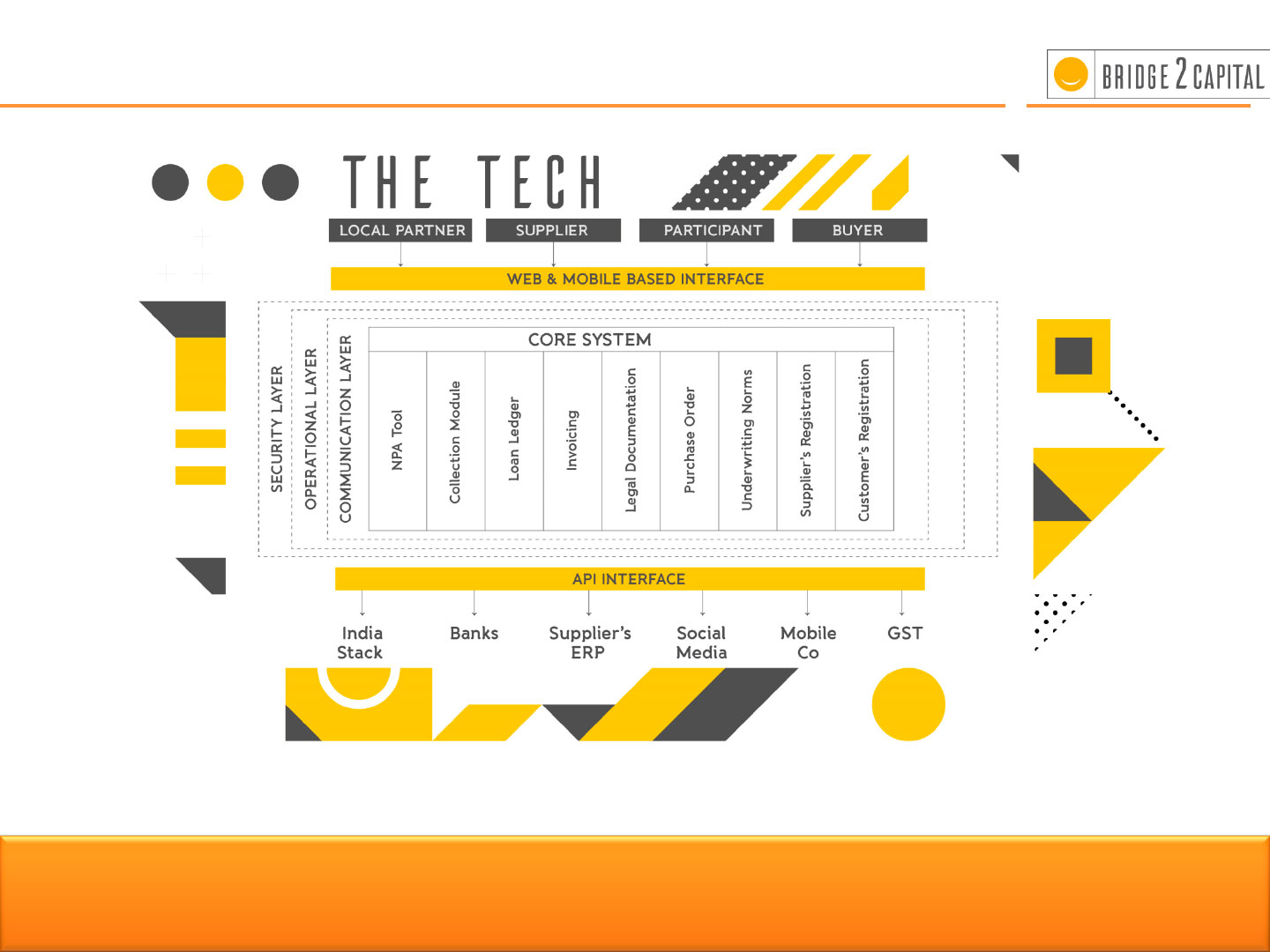

The Tech Model

5

Agenda

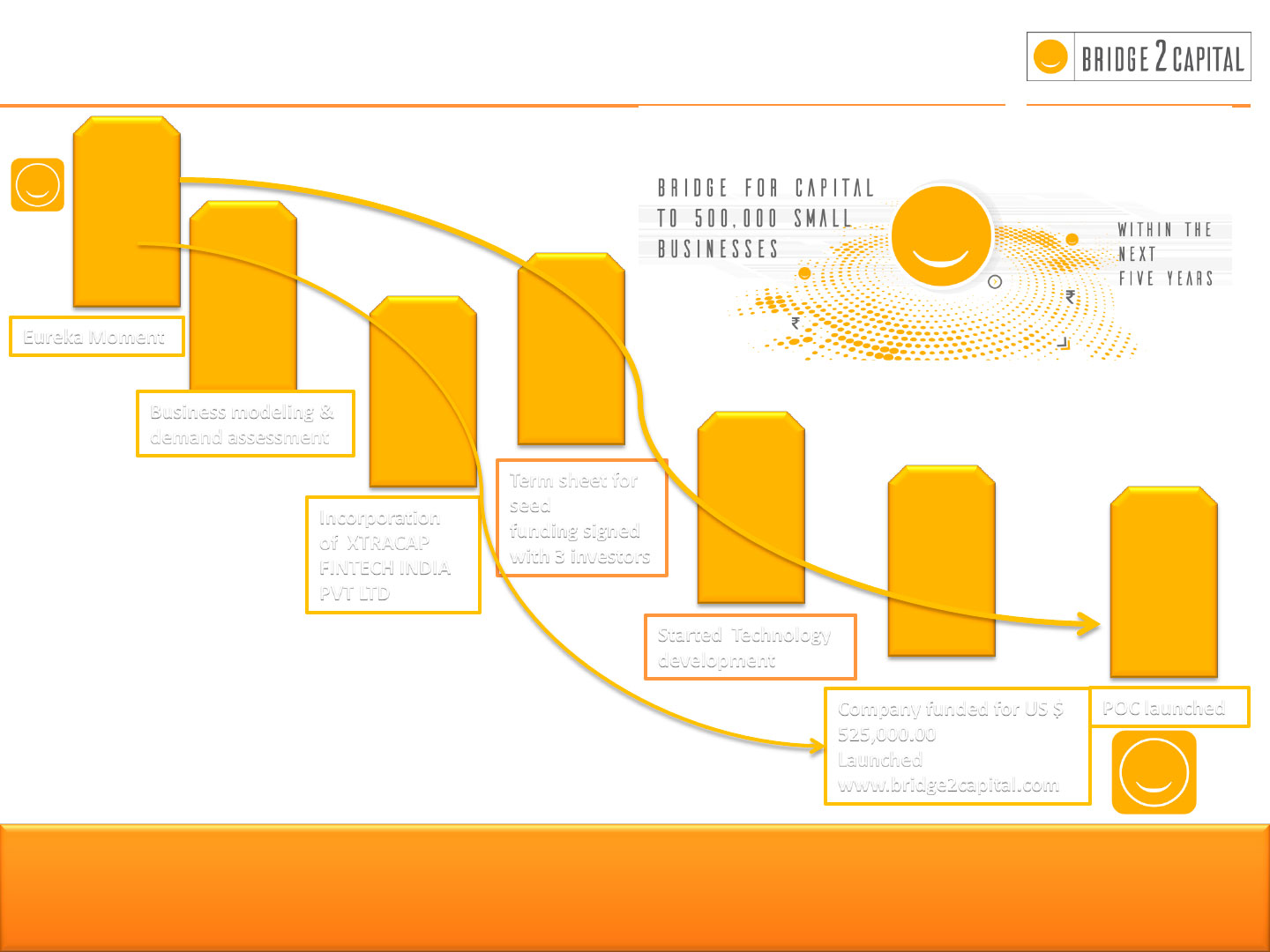

Mile stones

8 Nov

2016

Eureka Moment

Jan

to

Mar

2017

Business modeling &

demand assessment

Incorporation

of XTRACAP

FINTECH INDIA

PVT LTD

25

May

2017

July

2017

Aug

2017

Nov

2017

Term sheet for

seed

funding signed

with 3 investors

Started Technology

development

Company funded for US $

525,000.00

Launched

www.bridge2capital.com

Dec

2017

POC launched

Habit forming UI

• Implement

Feedback

Improvement

• Localization by

Multilingual System

• Real Time Aadhar

Verification

• E-Sign Verification

• Aadhar Secured

Encrypted Database

• Geo location based

tracking

• Social Parameters

• CIBIL Scoring

• Data Driven

Dashboards

Reporting

6

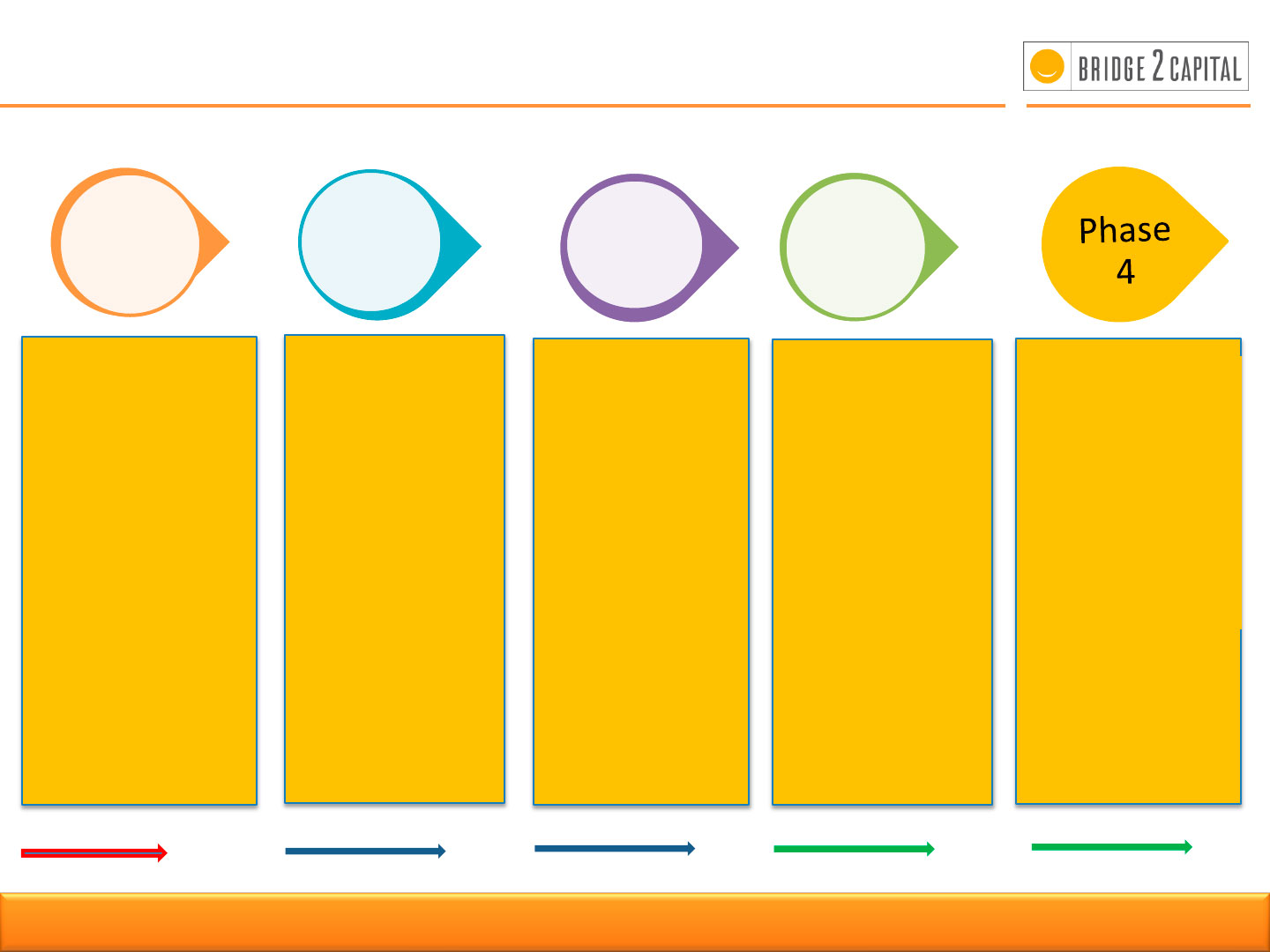

Introduction to Technology Road Map

• Habit Forming UI

• Implement

Feedback

Improvement

• Risk Rule Engine

• Third Party

Interface

Transaction

History

EWay Bill

GST

Credit scoring

Merchant Payment

Automation

• UPI

• AEPS

• Habit forming UI

• Implement

Feedback

Improvement

• Machine Learning

• Big Data

• Mobile App

Enhancement

Voice Based

command

search

• Easy Accessible to

Rural India

• Highly Secured

Architecture

• Encryption

Password

Pan Card

• Agile Process

• CIBIL Scoring

• End to End

Transaction

Security

• Better Customer

Engagement by

Mobile Apps

• NACH Pull

POC

Phase

1

Phase

2

Phase

3

0 – 4 Months

4 – 12 Months

12 - 18 Months

18 – 24 Months

24 Months……

Technology

Enhancement

Block Chain

• Bill collection

• Ledger Maintainace

• Credit Rating

• Social Inputs

Leveraging Authentic

Institutional

BLOCKCHAIN

7

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

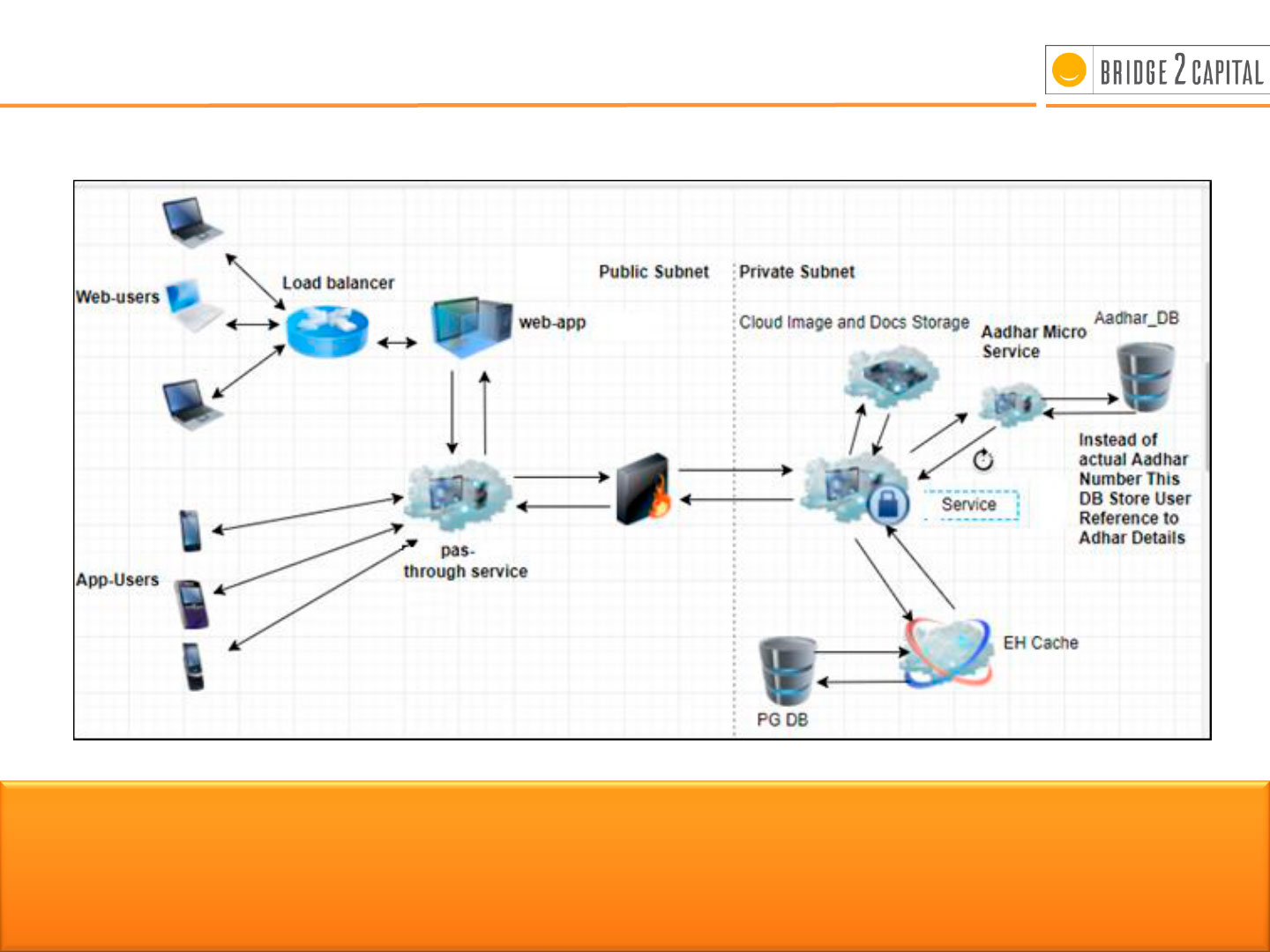

Architecture Model

8

Web

Mobile

DATA

Technologies

Technologies

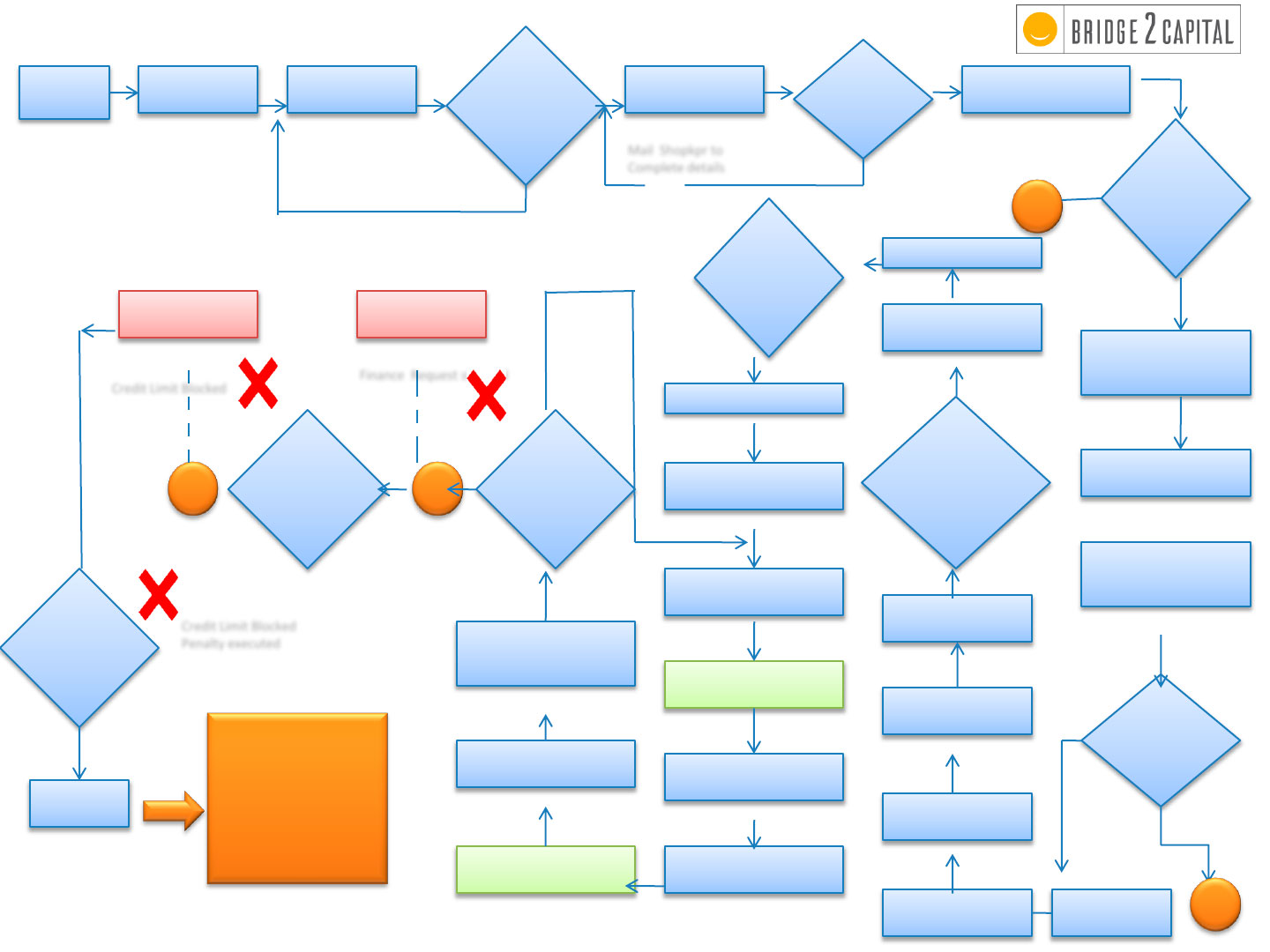

Start

Entrepreneur

Selected

Shopkeeper Sign

Up

Fill-in Required

Information

Upload Relevant

Documents

Are

Details

Compl

ete

Does

Borrowe

r has

Aadhar

Risk /Credit Rating as

per Criteria

Ops Team Validates and

request for Field

Verification

All Req.

Doc

Uploade

d

Entrepreneur Notified

for Field Verification

Field Team verifies with

Entrepreneur of

Shopkeeper premises

Details

as per

required

Notify to Shopkeeper &

Supplier

Approved Credit

Limit & ROI

Agreement signed

btw parties

Shopkeeper Adds

Supplier

Is Supplier

already n

Master list

Link sent to Sup to fill

in req info

Add to Supplier Master

Notify

Shopkeeper

Details

as per

require

d

Notify Supplier &

Shopkeeper

Bridge2Capital Team

Validates and Approves

Sup fill in req info

Y

N

Y

Shopkeeper Req. Finance

upload Order

Y

Shopkeeper Req. Finance

upload Order

Bridge2Capital Team

Verifies & Validates

Amount Disbursed to

Supplier Bank A/c Directly

Notify EnterP,

Shopkpr,Mgmt

Notify to Shopkeeper &

Repayment of

Disbursement starts

Has the

Daily

Amt

Repaid

Has the

Daily

Amt

Repaid

Has the

Daily

Amt

Repaid

Notify EnterPre,

Shopkpr,Mgmt

Shopkpr@D

efaulter

Y

Finance Request stopped

Credit Limit Blocked

Credit Limit Blocked

Penalty executed

Defaulter

Recovery

Model

Mail Shopkpr to

Complete details

N

Y

Operational Workflow

1

0

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

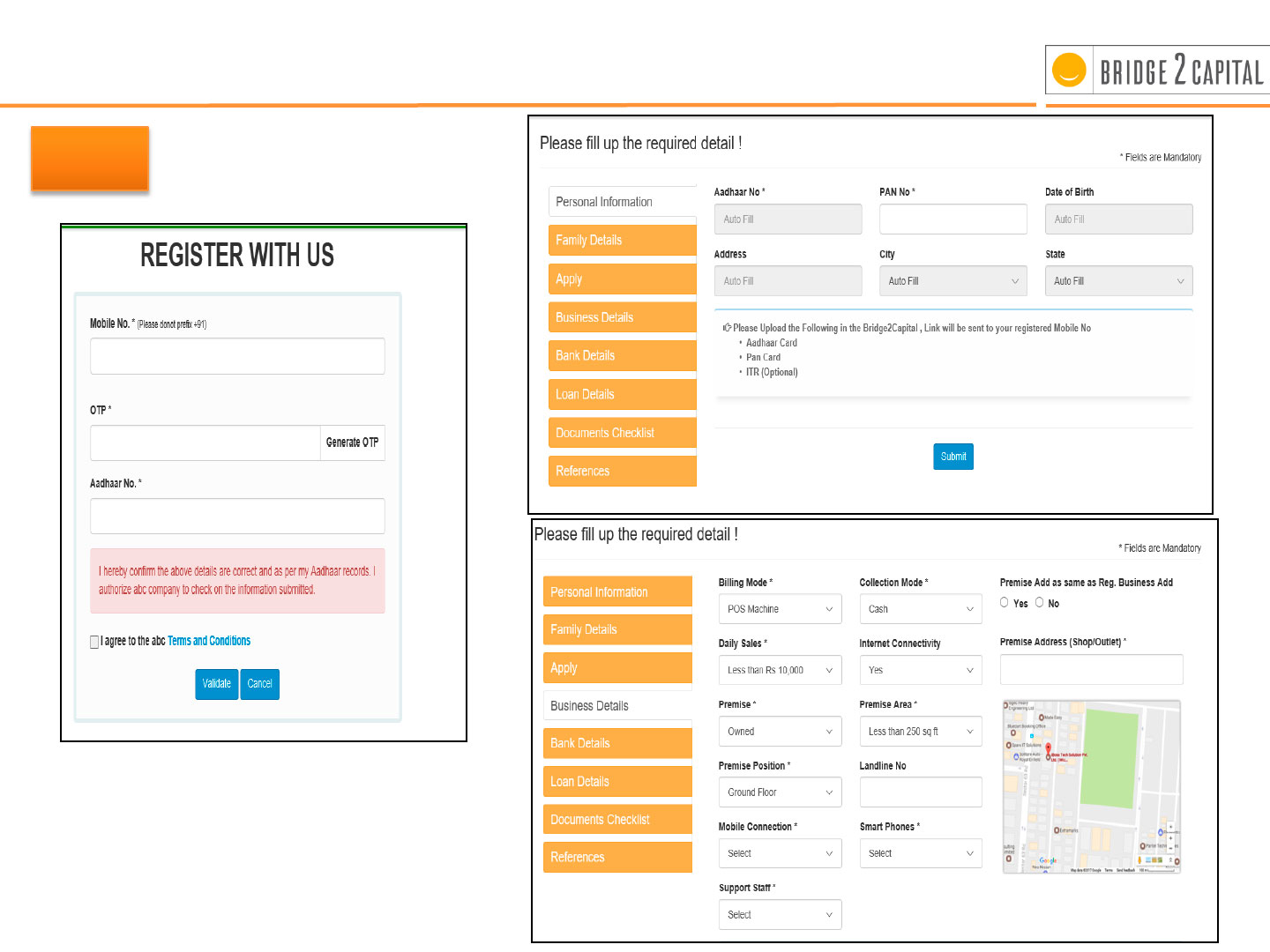

tab www.bridge2capital.com

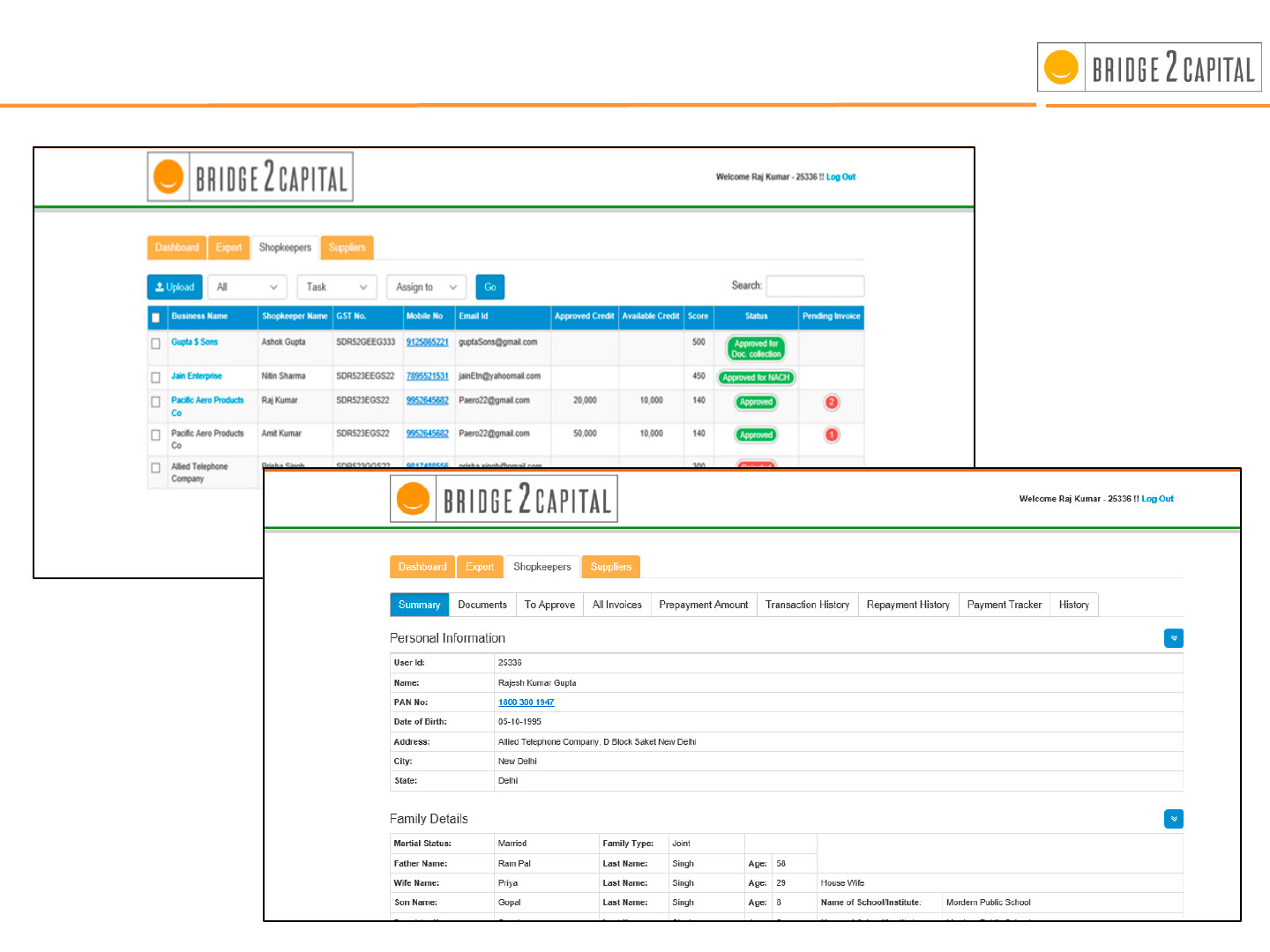

Shopkeeper Registration

Apply

1

1

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

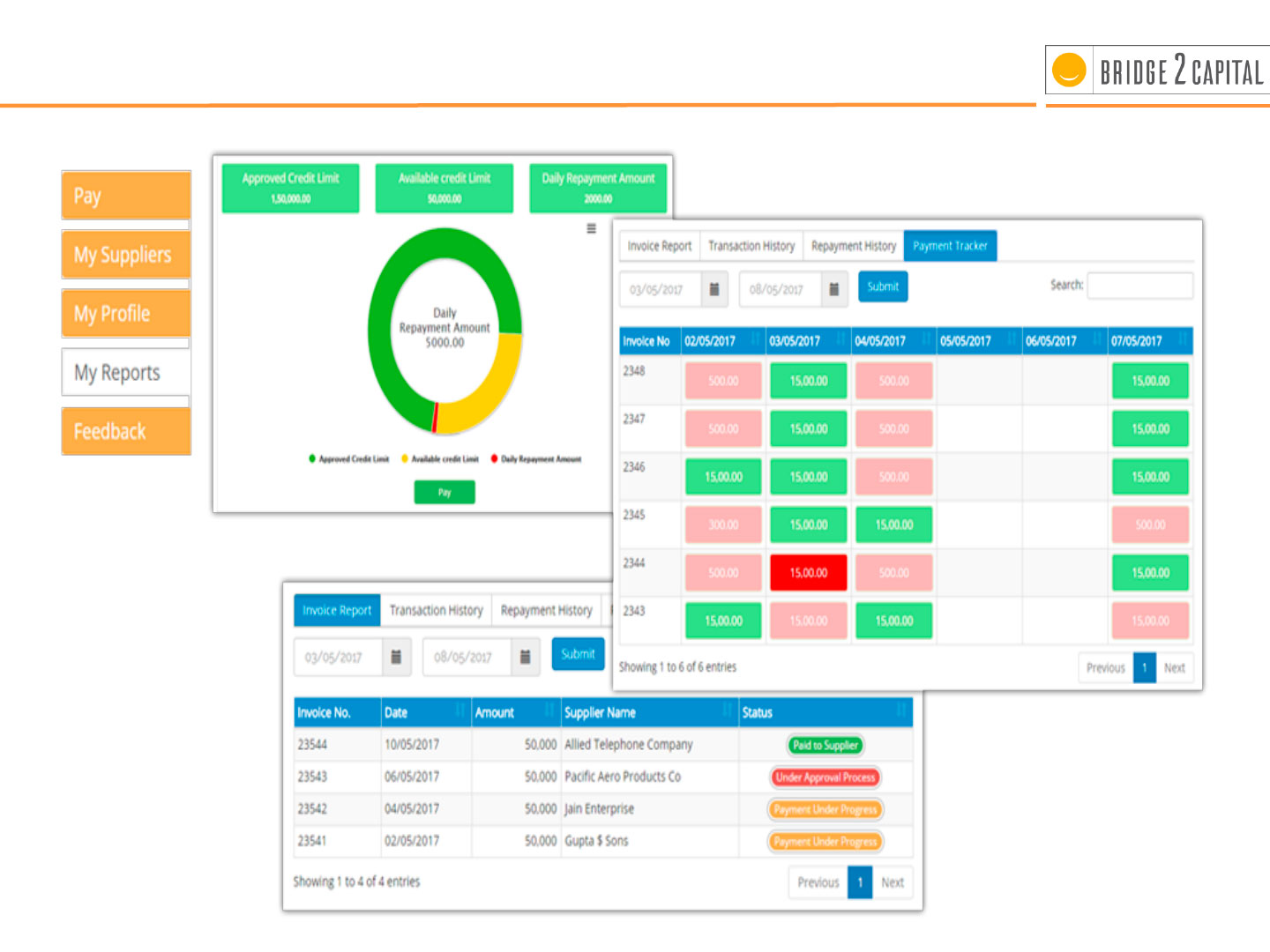

Shopkeeper Dash Board

1

2

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

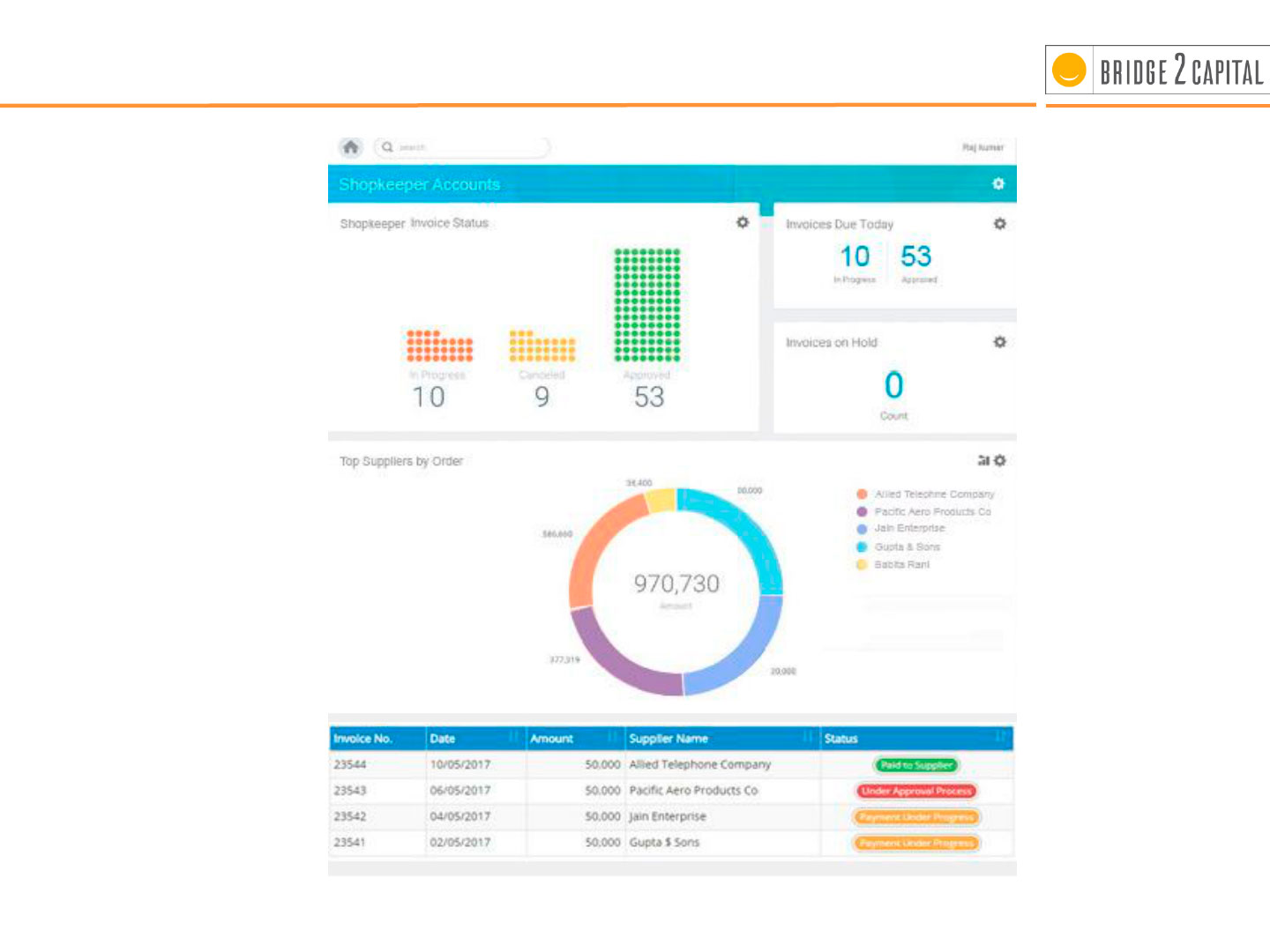

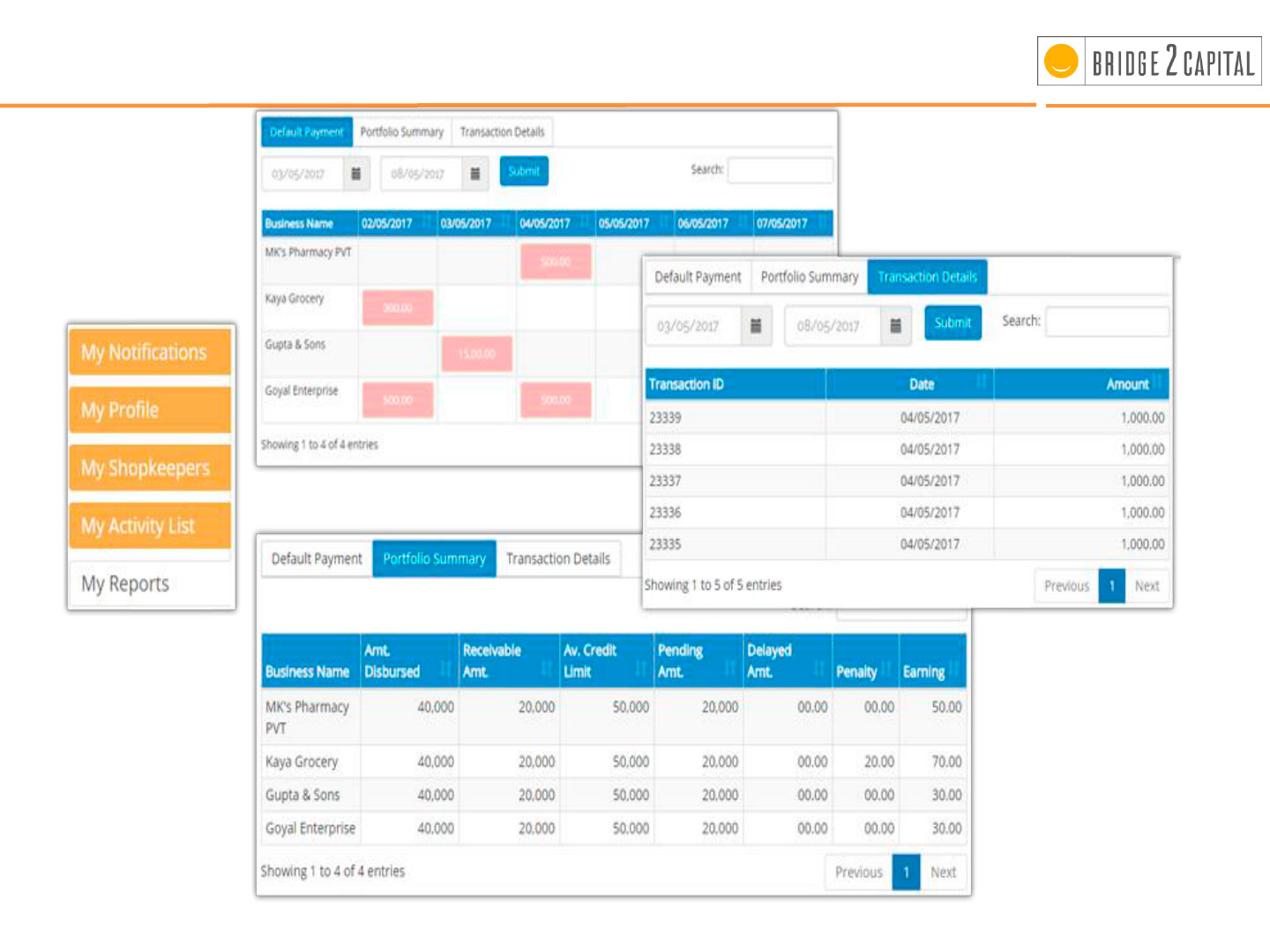

Summary for the Shopkeeper

1

3

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

Local Partner Dash Board

1

4

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

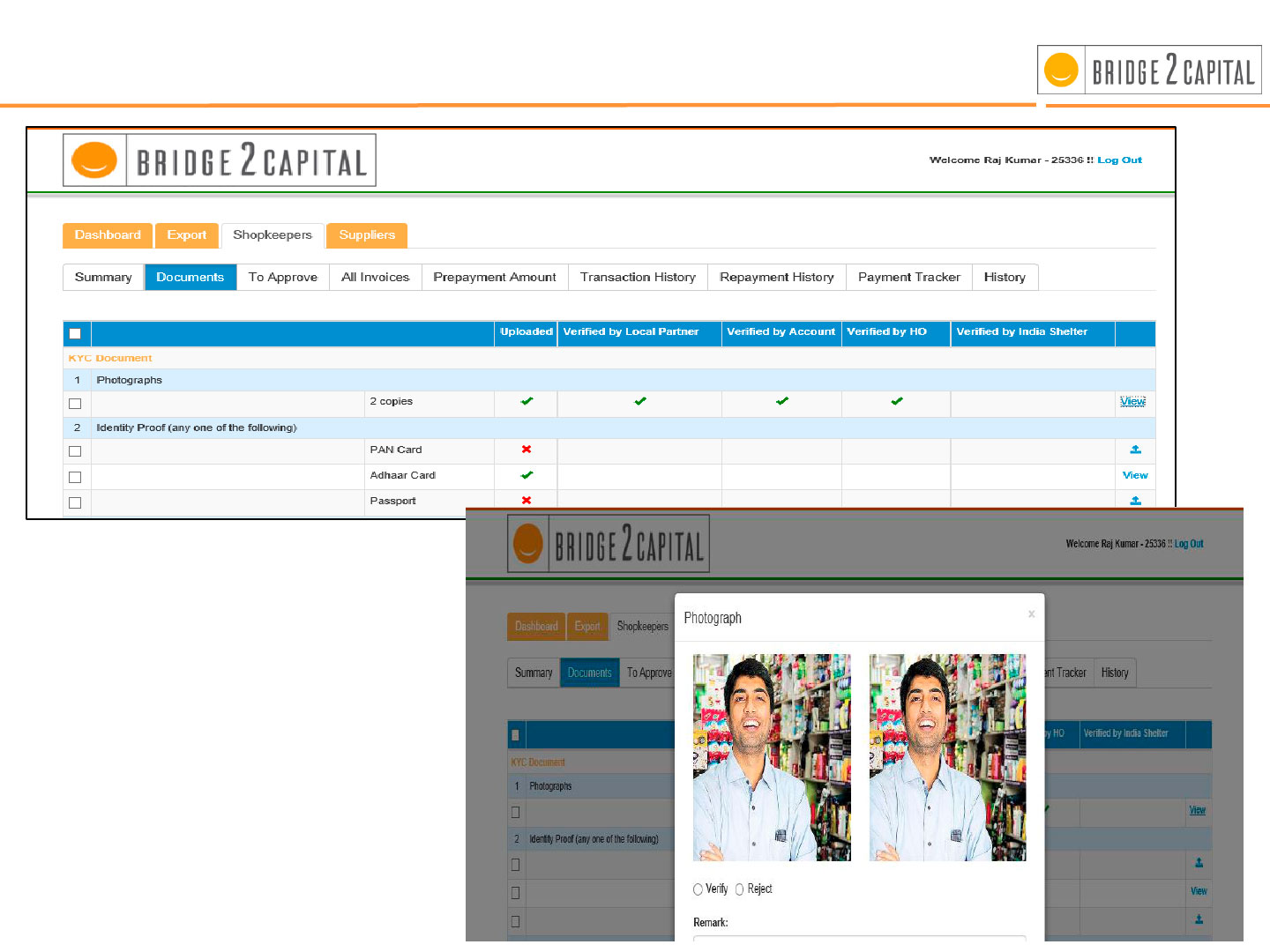

Shopkeeper Management Workflow

1

5

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

Approval of Shopkeeper Portfolio & Loan Request

1

6

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

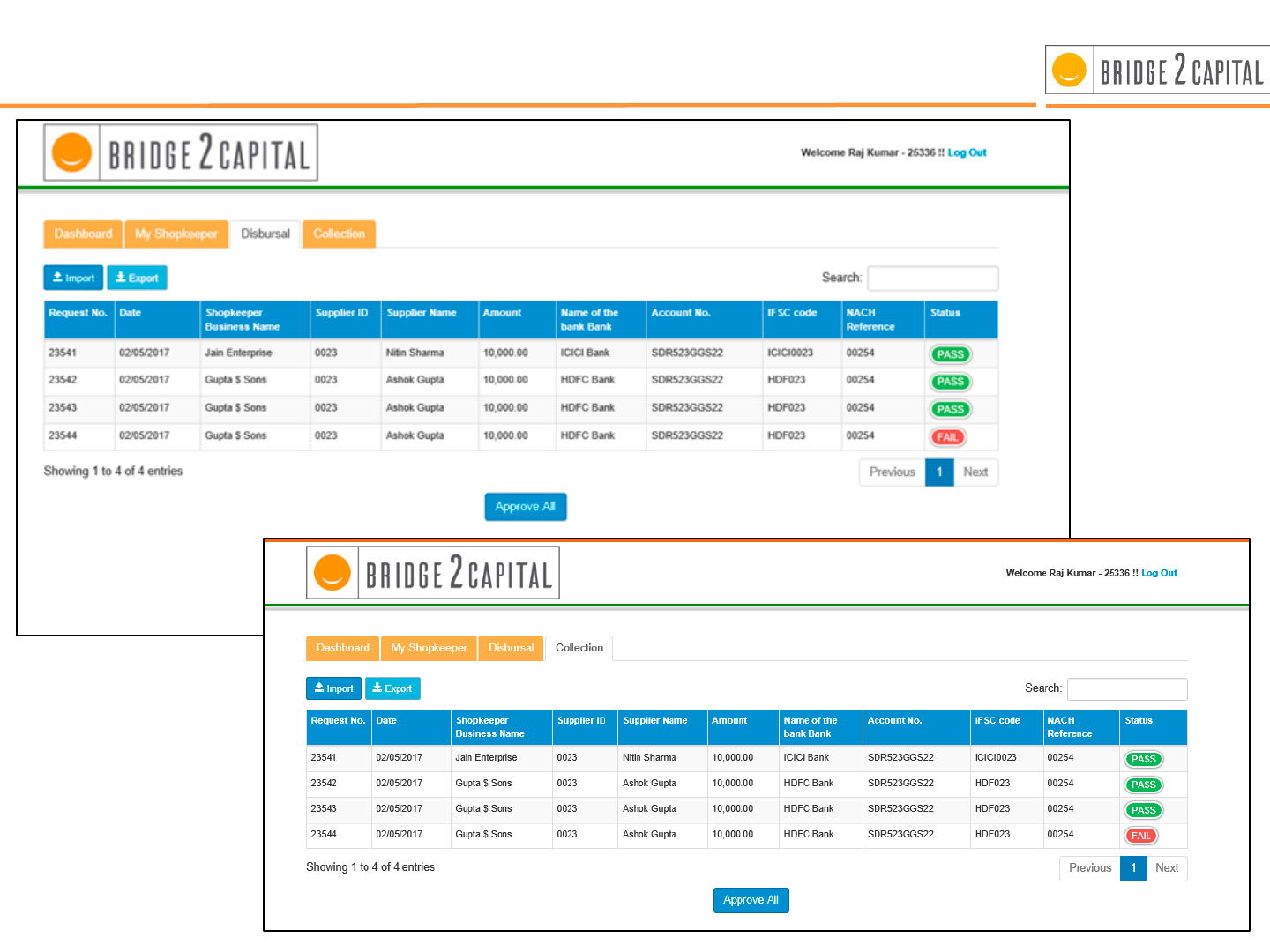

Disbursal & Collection Management

1

7

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

Invoice Upload – Mobile App

1

8

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

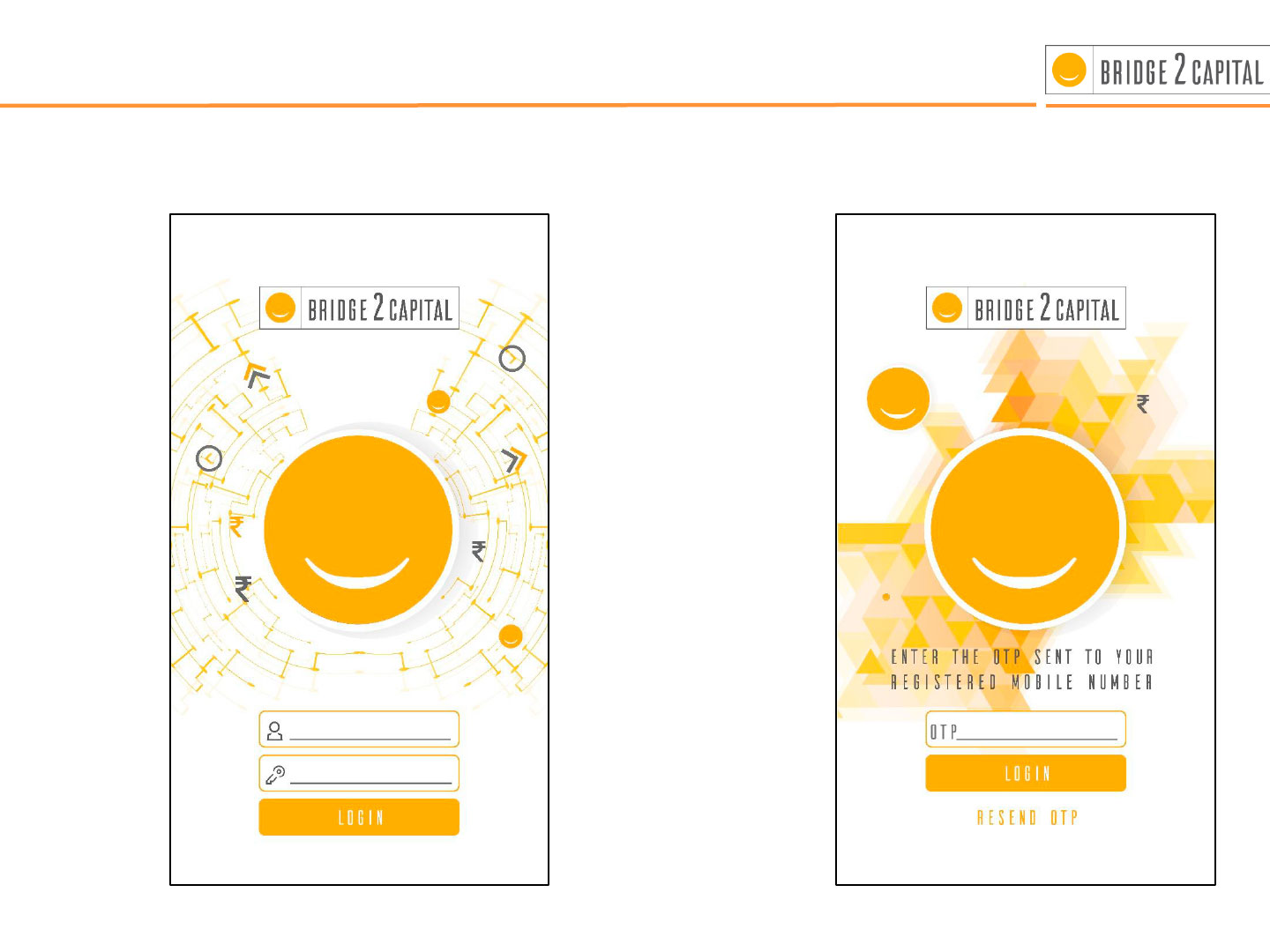

Invoice Upload – Mobile App

Login Screen

Verification By OTP Driven

process

1

9

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

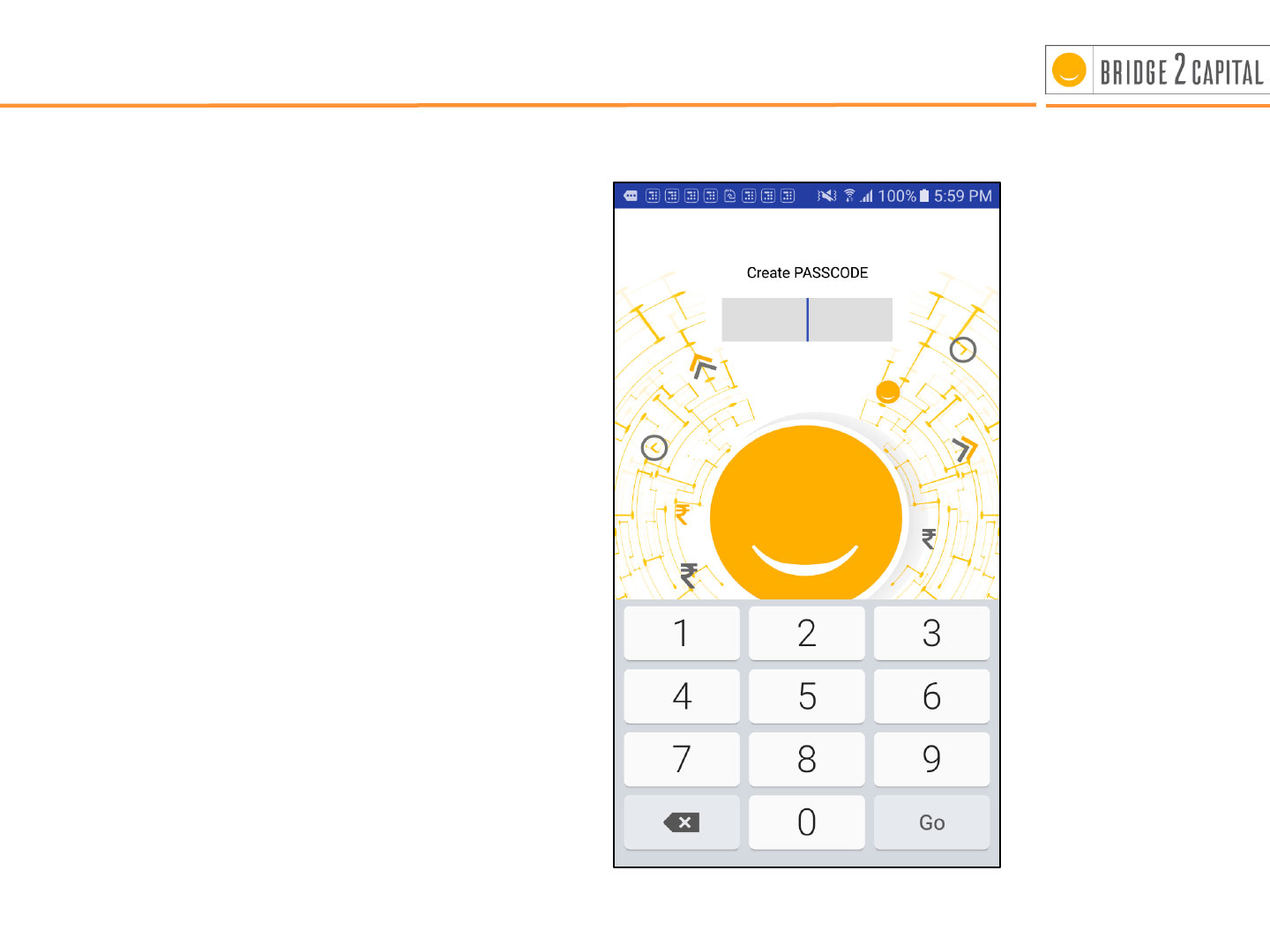

Invoice Upload – Mobile App

Create Personal Passcode for

added security

2

0

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

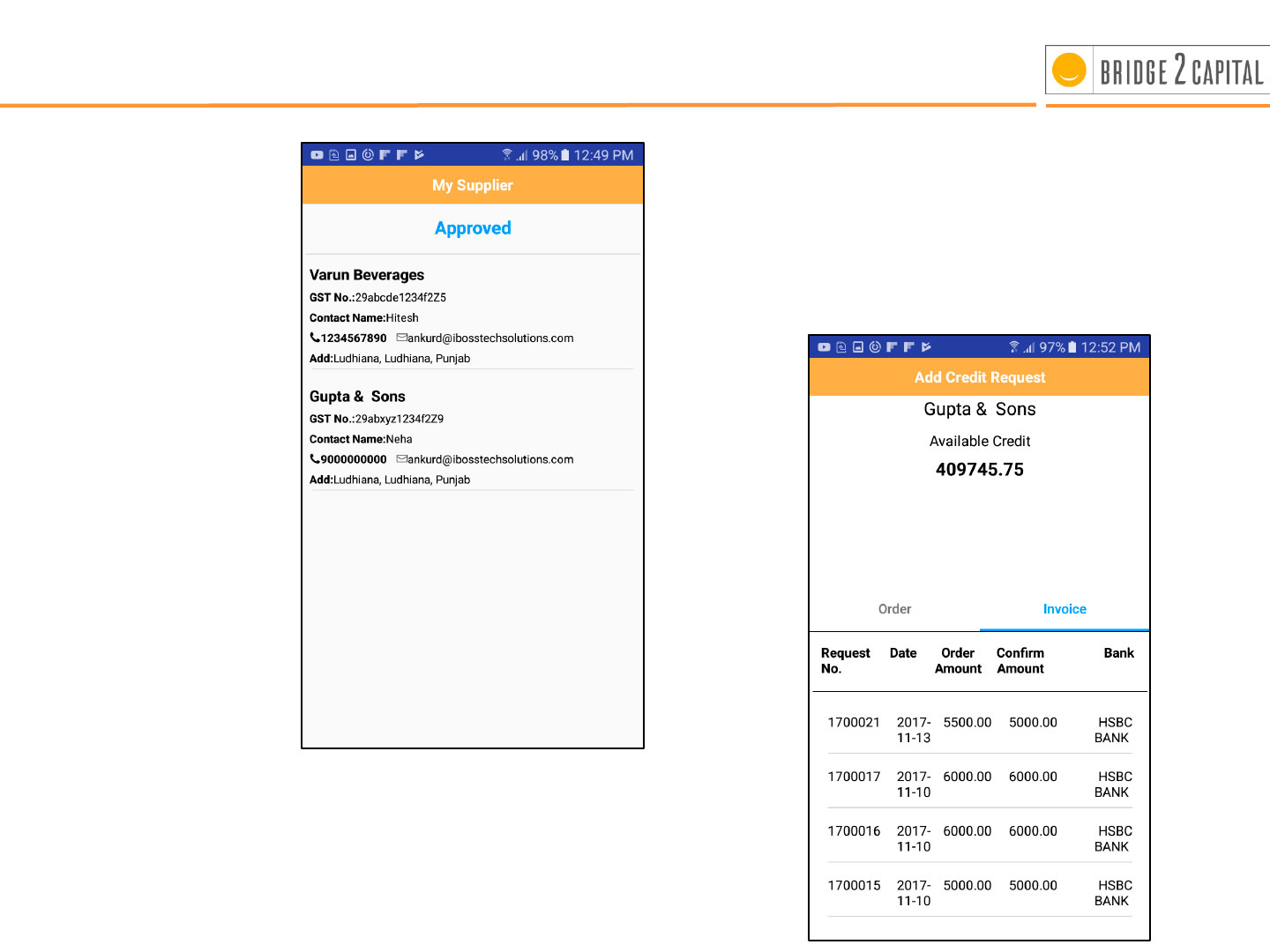

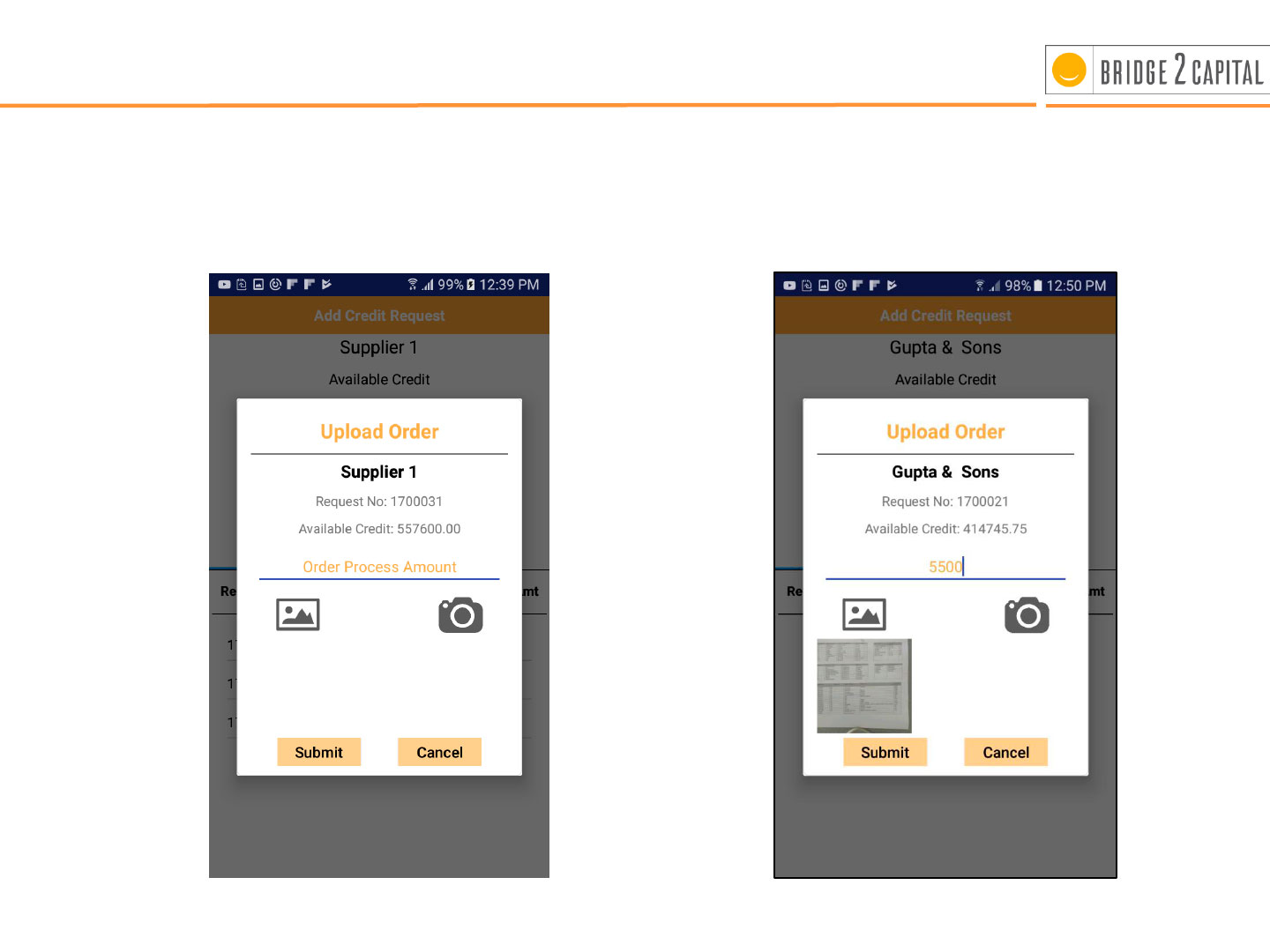

Invoice Upload – Mobile App

Approved

Supplier List @ go

Request Credit at just a click

against approved supplier

2

1

Agenda

Web

Mobile

Web &

Mobile

DATA

Upload Order Screen

Invoice Upload – Mobile App

2

2

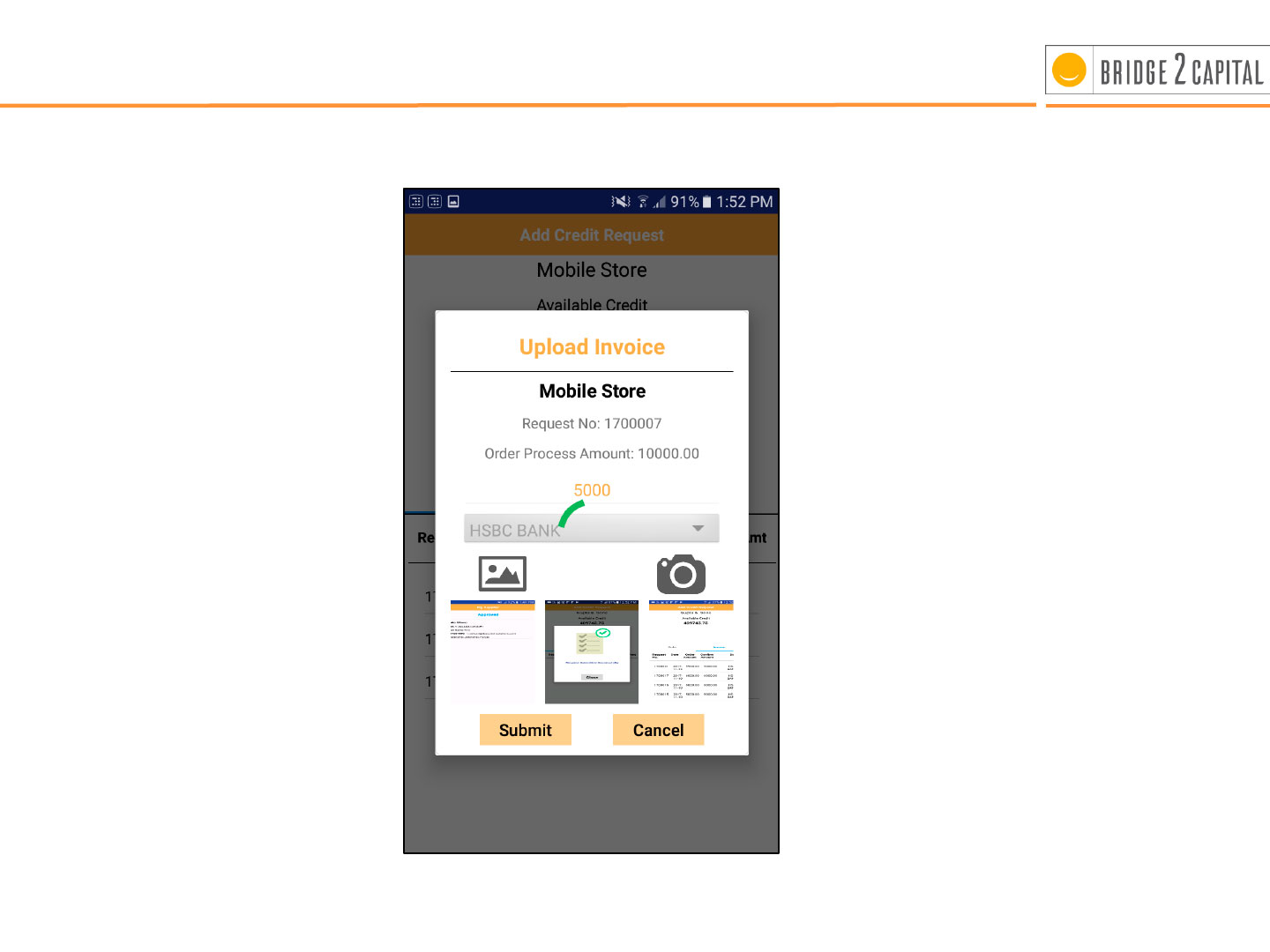

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

Invoice Upload – Mobile App

Upload Invoice

2

3

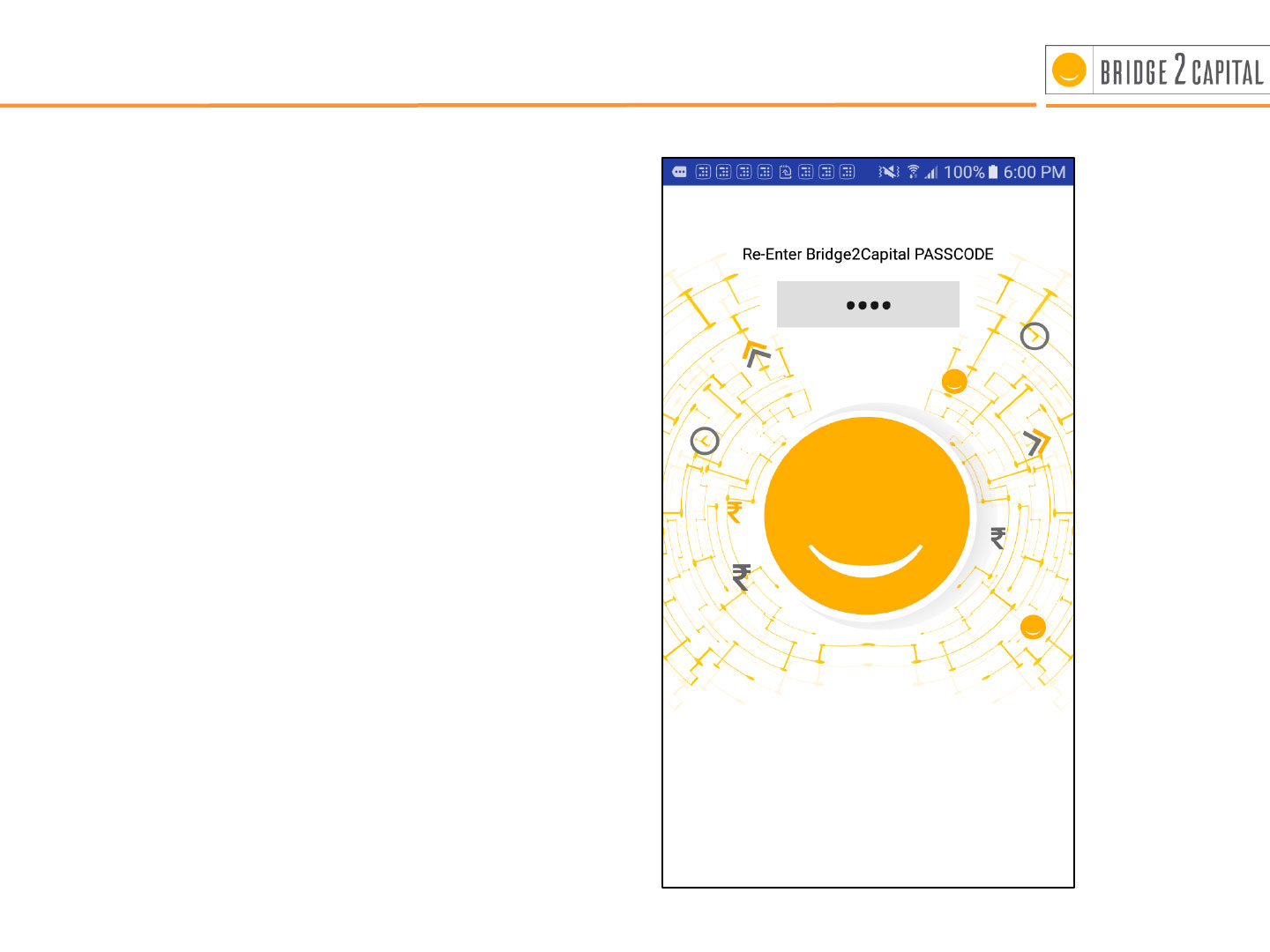

Agenda

Web

Mobile

Web

Mobile

Web &

Mobile

DATA

Invoice Upload – Mobile App

Confirming Transaction by

re-entering the Personal

Passcode

2

4

Agenda

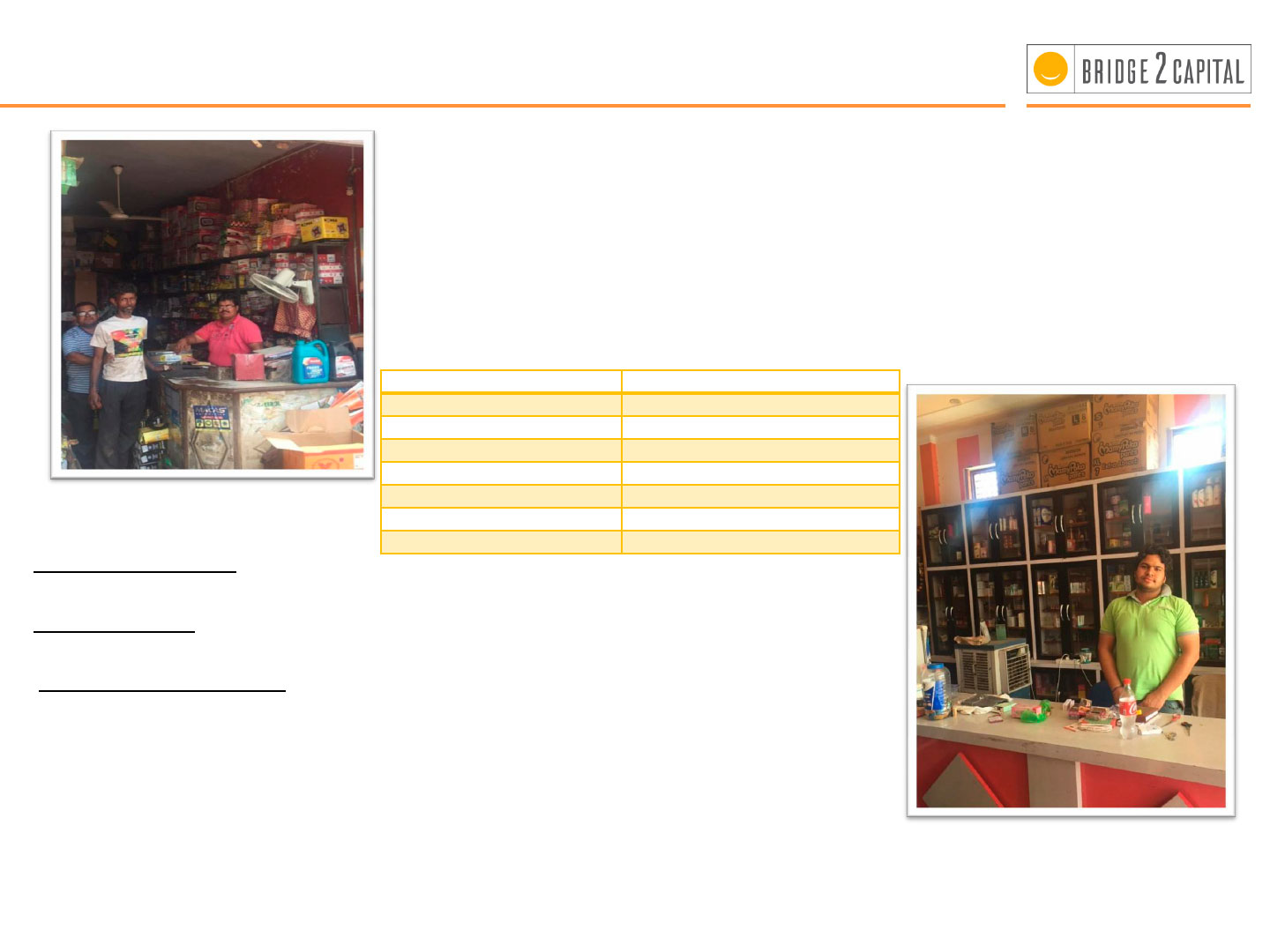

Proof of Concept – Alwar, Rajasthan

We have visited 500 retail outlets and explained our business model of

working capital/invoice financing, 90 % of the shop owners liked the

idea and wanted to avail the facility either immediately or in due

course of time. 80 shopkeepers have been shortlisted for the launch and

will be on- boarded on to the Bridge2Capital platform

Type of Outlet

%

Apparels

10

Electrical Appliances

10

Footwear

17

Hardware

10

Grocery

30

Mobile Phone Store

10

Pharmacy

13

Mix of the shopkeepers

Average Credit Limit

Most of the shopkeepers wanted credit limit of Rs 1-3 Lacs and a term of 30 – 45 days.

Average Bill Size

Rs 5000/- to 20,000/- to be financed

Feedback from Suppliers

We collected the list of suppliers from the shortlisted shopkeepers and visited them

to explain the concept. 90 % of the suppliers have agreed and are willing to partner

with us. They feel this would help both the shopkeepers and the suppliers to manage

the cash flow effectively.